Stop Reacting to Volatility and Start

Profiting from It

The EFC Program: The Smarter Metal Price Forecasting Solution

Through EFC’s partnership with MetalMiner, you gain access to MetalMiner’s “Market Signal” solution at a rate that’s out of reach when buying direct. With predictive insights, negotiation muscle, and flexible coverage, the program gives you the power to better protect your margins and plan with confidence, all while saving compared to the MetalMiner direct price.

Why Volatility Erodes Margins

Procurement and finance leaders both feel the same pain. Supply disruptions and energy policy shifts are driving metal prices to swing wildly. Traditional econometric and technical models assume stable, linear relationships, which rarely hold in the face of price shocks.

The biggest problem? Your current price indexes tell you what happened yesterday. They don’t tell you when to buy, when to wait, or how to push back on a supplier’s increase. That gap costs your company money.

Why Traditional Models Fall Short

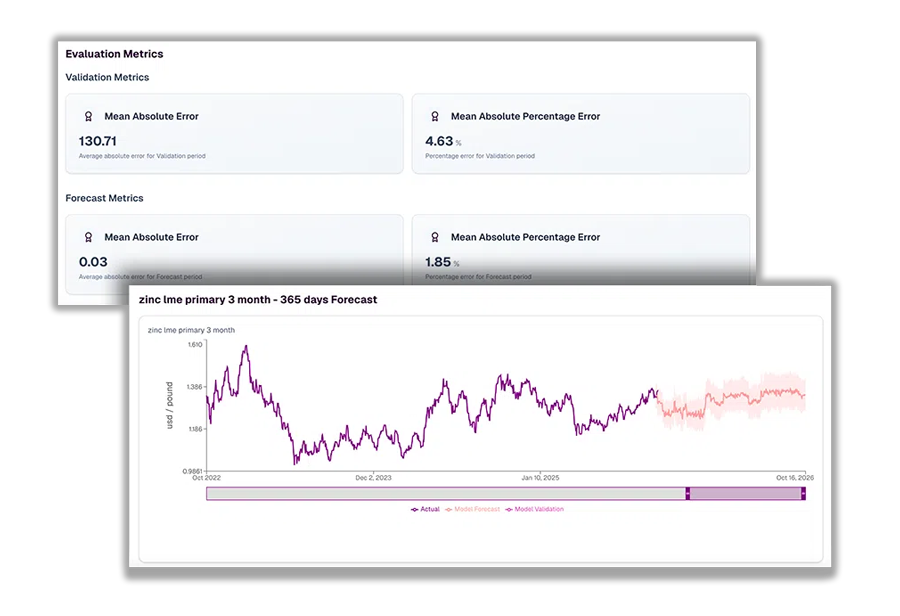

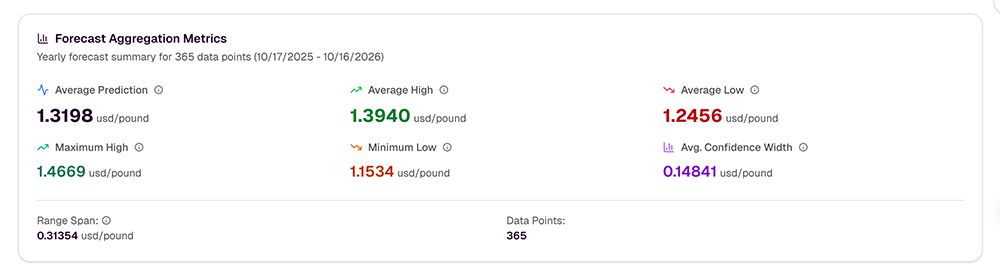

Traditional models break when conditions change. Market Signal was built precisely for volatile markets. By combining machine learning, technical analysis, and deep industry expertise, it adapts quickly to shocks and separates meaningful drivers from noise. Every forecast is accompanied by explanations so you can see why the outlook moved and what variables matter most.

The Solution: EFC & MetalMiner's Market Signal

The EFC Metals Forecasting Program combines MetalMiner’s Market Signal platform with the reach and credibility of EFC. Market Signal ingests dozens of inputs: supply chain data, policy shifts, futures curves, and more. The result?

- Forecasts that are regularly retrained when they fall outside a

6% error rate. - Trusted under a government-funded program focused on critical supply chain intelligence.

- Help in reducing costs, volatility, and overall improvement in forecasts.

- Cuts in hedging reactivity.

What You Get and Why It Matters

Short‑ and Long‑Term Forecasts

Scenario‑based long‑range projections to show you where prices are headed and when to act.

Personalized Price Point Selection

Select only the price points you need, whether that’s copper, aluminum, nickel, hot‑dipped galvanized, grain‑oriented electrical steel, or others. Add any additional metals at a low per‑metal cost.

Real-Time Alerts

Receive alerts when the market crosses key technical thresholds to stay ahead of rallies and protect budgets.

Reports on Electrical Steel

Special reports on grain‑oriented electrical steel and other alloys relevant to transformers, motors, and automation ensure the intelligence is tailored to Canada’s electrical industry.

Buying Signals

Market Signal tells you when to buy, when to wait, and how to structure your contracts, helping companies achieve double‑digit savings.

Unified Industry Voice

EFC brings together manufacturers, distributors, and service providers across Canada, giving members access to advocacy, standards, and business intelligence they could not achieve on their own.

EFC members get all this at a fraction of the cost of buying directly through MetalMiner.

Questions About Our Product Offerings?

Built for Every Type of Decision‑Maker

Procurement Managers

Stop chasing commodity news. Automated alerts and reports keep you on top of the market while freeing up hours each week.

CFOs & Finance Teams

Avoid budget blow‑outs caused by unexpected price swings and lock in contracts at the right time. Scenario‑based outlooks quantify the financial impact of tariffs, supply disruptions, and policy changes, enabling proactive hedging or contract strategies.

Supply‑Chain Executives

By purchasing through EFC, you save approximately 23% on the 6‑price point package and up to 60% on the market report package compared with buying direct.

See the Comparison for Yourself

By purchasing through EFC, you save approximately 23% on the 6‑price point package and up to 60% on the market report package compared with buying direct.

Choose the package that fits your needs:

EFC Forecasting Package

- Any 6 metal prices

- Short-term forecasts

- Monthly Metals Outlook Report (See sample)

- 1 long-term forecast (updated monthly)

* All price points include short-term forecasts. Additional price points: $1,500 a piece.

$14,000

You save $3,000 through EFC:

$11,000

EFC Intelligence Program

- Monthly Metals Outlook Report (See sample) + 1 Price Point*

OR

-

Grain-Oriented Electrical Steel Quarterly (See sample) + 1 Price Point*

*All price points include short-term forecasts. Additional price points: $1,500 a piece.

MetalMiner direct price: $7,500

You save $4,000 through EFC:

$3,500

Ready to Outsmart Volatility?

Don’t let market uncertainty erode your margins. Join the EFC Program and turn price volatility into a competitive advantage.

Choose Your Package: